Picking up where the Great Society left off

Pay attention. A sea change in thinking is underway.

You might be tired of me talking about the American Rescue Act, which is now back to the House of Representatives and expected to pass today before going to the president’s desk. But while the rest of the country is talking about Joe Biden’s dog, and while the press corps is asking about the White House cat (I am, alas, quite serious), we should talk about how this legislation, the first of more to come, reflects a sea change.

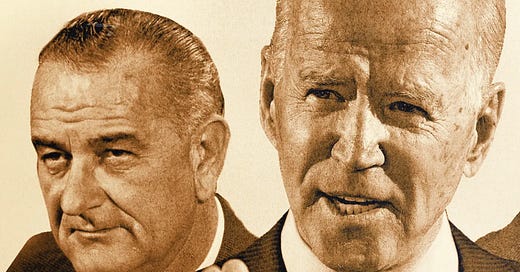

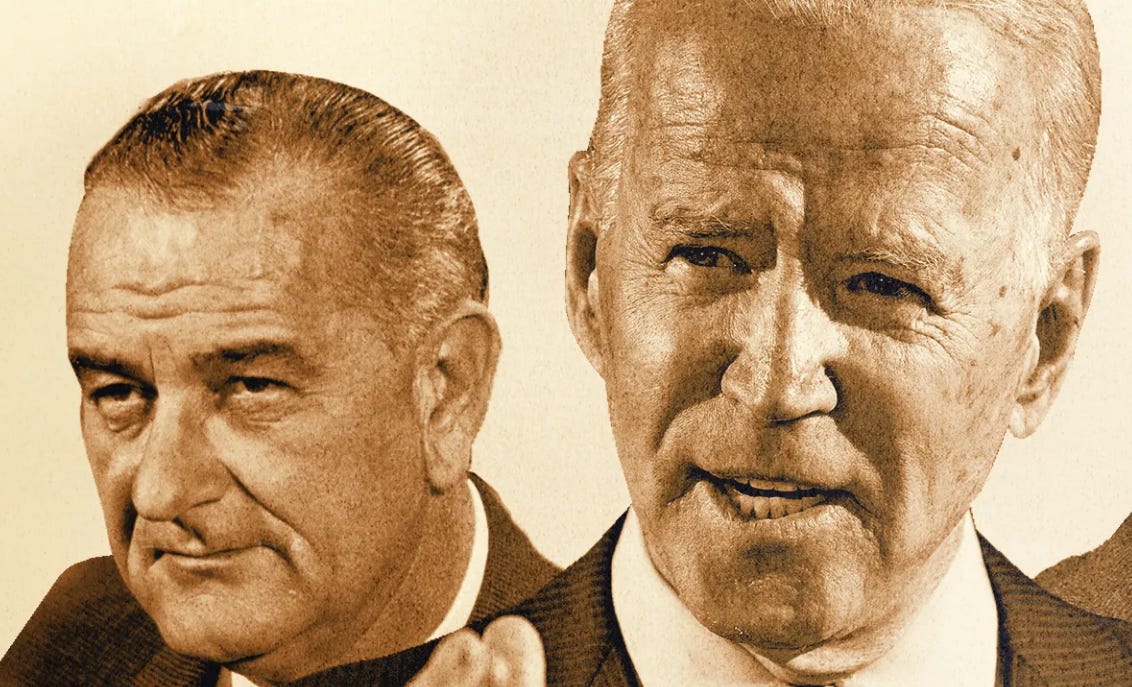

That sea change might be described as the difference between being a citizen who is inherently worthy of help by dint of being a free citizen as opposed to being a deserving person who is worthy of help by dint of being a deserving person. The latter is pretty much the core belief animating the conservative approach to welfare, an approach enshrined in economic policy by the Clinton administration, while the former is pretty much the core liberal approach of the Great Society that never got off the ground fully because the Vietnam War consumed Lyndon Johnson’s presidency.

The conventional wisdom that endured for decades is making way for something new. We are moving in the direction of being worthy of help by dint of being free citizens.

Put another way, it has been conventional wisdom for decades that if you got help from the government, you had to show you deserved it by working. If you did not work, at least a little, you were undeserving of help. The government has an interest in your working, because the government has an interest in promoting productive labor, self-improvement, and in general a strong and robust national economy. A government that does not take into account deservingness is vulnerable to abuse, fraud and waste.

This conventional wisdom was so unquestioned a dozen years ago, in the aftermath of the 2008 panic, that it was downright dangerous, reputationally speaking, to suggest that maybe 40 percent of the $789 billion stimulus bill enacted in the early weeks of the Obama administration should not go to tax breaks given that tax breaks don’t help people who aren’t working. A better policy—and this was the dangerous part—was pitching people bales of cash. The Republicans already called any form of welfare a “government handout.” Could you imagine what they’d say about an actual handout?

Resistance to the idea of direct cash payments to needy people wasn’t just political. Mainstream economists and orthodox policymakers genuinely feared inflation of the kind that paralyzed the country before the era of conservative politics began. The late 1970s saw a double whammy of stagnant wages and rising prices so that it mattered less how hard you worked—you still could not get ahead. The prime objective then was crushing inflation in order to maximize employment. And for the most part, the scheme worked until the 2008 panic. By then, however, the conventional wisdom was so deeply rooted the concept of printing money for needy people was unthinkable.

Here’s the tip jar! Put something nice in it!

In the past year, however, we have seen the United States Congress pass five rounds of stimulus spending, trillions of dollars’ worth, with a sixth round on the way. The new law would set up a permanent structure by which virtually all American children would receive direct cash subsidies. We have also seen a Federal Reserve chair, Jerome Powell, flip the order of the central bank’s twin mandates. When Paul Volcker was the chair, he elevated price control over full employment. He raised interest rates in the late 1970s to stop inflation. Four decades later, Powell is unconcerned with inflation, as are most mainstream economists and policymakers. He has repeatedly privileged full employment over price control. The Fed has been printing all the cash needed to prevent the economy from spilling over the edge during this time of the covid.

And no one is talking about deservingness. No one is talking about “work requirements.” The very concept of “workfare” seems moldy. Sure, the Republicans in the Senate say they are worried about deficits and so on. (Rick Scott, Senator of Florida, told Bloomberg TV there will be “a reckoning.”) But that’s not going to hold water for the 75 percent of Americans who want the Congress to pass the American Rescue Act. That’s not going to be persuasive to Americans who want the government to spend more—trillions more on things like paid sick leave and paid family leave and other income-support programs necessary in a 21st century economy. All of a sudden, the conventional wisdom that endured for decades is making way for something new. We are moving in the direction of being worthy of help by dint of being free citizens.

In a very real sense, Joe Biden’s first major piece of legislation picks up where Lyndon Johnson’s Great Society programs left off, according to historian Joshua Zeitz. He wrote on Twitter that critics believed that the Great Society focused too much on “‘qualitative’ measures—education, health care, job training, housing—intended to put people in a position to capture their share of prosperity and economic growth.” Critics believed that people needed cash instead, he said. The Johnson administration eventually came around but by then the president was focused on the Vietnam War.

Compared to Johnson’s Great Society programs, “the Biden relief plan poses a radical departure in liberal thought,” Zeitz wrote on Tuesday. “It provides ongoing direct payments to 93 percent of families with kids, one-off cash to many more. That goes way beyond the Great Society, whose framers considered and rejected income support.” In the 20th century’s final quarter, Zeitz said, “Democrats had to settle for defending the important but patchwork range of Great Society programs that were never intended to counter the decline of unions, growing income and wealth inequality. Something more radical than the Great Society was unthinkable.

“Until now.”

If only the press corps were paying attention to more than cats.

—John Stoehr

I haven't seen much in the media that explains why inflations has stayed so low, and I don't know how much of it has to do with Fed policy. Much more impactful, as I see it, are at least three things: (1) The results of Moore's Law, which predicts that computing power would increase incrementally while its cost would shrink. From home PCs to the Internet to the cloud, look at how this has driven new businesses--which can produce phenomenal revenue with relatively few jobs. This is one reason for (2) Today’s real average wage (that is, the wage after accounting for inflation) has about the same purchasing power it did 40 years ago, as Pew data shows--aside from the highest-wage workers, of course. Personally, I see comparable jobs in publishing paying the same or less in dollars (not inflation-adjusted dollars, plain old dollars) as I was making 30 years ago. Even when we saw "full" employment, economists were stumped as to why wages didn't grow. That's because we humans were being replaced by automation or AI, and white-collar managers were deemed unnecessary. Who wanted and benefitted from "flat" organizations? And (3) what I call the Walmart Effect. There were discount stores before Walmart, but they did not have the intention and clout to demand that their suppliers reduce what they charged for any given product year after year. Other retailers had to stay close to Walmart prices or die. Consumers didn't see prices go up for food or clothing (although housing & healthcare costs soared), so the constraints on consumer pricing masked the effects of stalled wages. Then, online businesses brought prices down further by disrupting whole businesses, including Amazon, Netflix, Uber, AirBnB, etc. All this caused complacency, while the rich got richer and richer and richer. All this is in support of what John says. Corporations and the GOP have been feeding off us for too long!

Another related topic: student debt and prospect of debt cancellation. It's floated on the sidelines, but it should be central for 4 key reasons.

1) Moral: Debt financing of college was a Reagan-era sea change. It was built through tax cuts and reduced federal funding to support state budgets and public-financed postsecondary education. To offset the possible decline in student enrollments owing to rising college costs, student lending was turbocharged. The result has been waste, fraud, financially-driven dropouts, lots of interest payments, an exploding debt collection industry (aided abetted by medical bankruptcy), and much else. And it's debt that is harder to escape, requiring add'l legal steps to be discharged via bankruptcy.

2) Financial: Money spent on other aspects of the economy is instead spent paying back loans, often undercutting the ostensible goal of the education--to raise the overall living standard for the impoverished, the working class or the lower middle class. It would likely inject money into our economy right away, which is otherwise being paid mostly to...the U.S. government.

3) Political: Politics is a blood sport. You don't get a trophy for coming in second. Students voted heavily Democratic. They should be rewarded on of the key policy issues that moved that vote: student debt relief. And how good is the politics of student debt relief? 43 million individuals. Now compare that to the minimum wage problem. How many federal minimum wage (or lower) workers are there? Around 1.7 million.

4) Legislative: Biden can actually cancel student loans (or rather student debt) by executive order. While Republicans might contest this in court, a legislative approach, unless it can be done as another reconciliation vote, will not occur. In the scheme of things, it's one of the easiest pro-growth, pro-voter, pro-right thing to do tacks to take.

And no, there really is little in the way of moral hazard to consider; good press will heavily outweigh bad press (regardless of how Fox News will play it); and, no, it won't affect banks because the U.S. holds all of the loans. The cost of the $50K cap per borrower cancellation plan? $650B (1/3 of the current relief plan) and the likely resultant bump in consumer spending will put much of that behind us in short order. My biggest concern ironically enough is you might see a housing bubble because finally student debt strugglers can finally start families and buy homes.