Are the Republicans really going to say no to $4 trillion in public investment? Yeah, probably

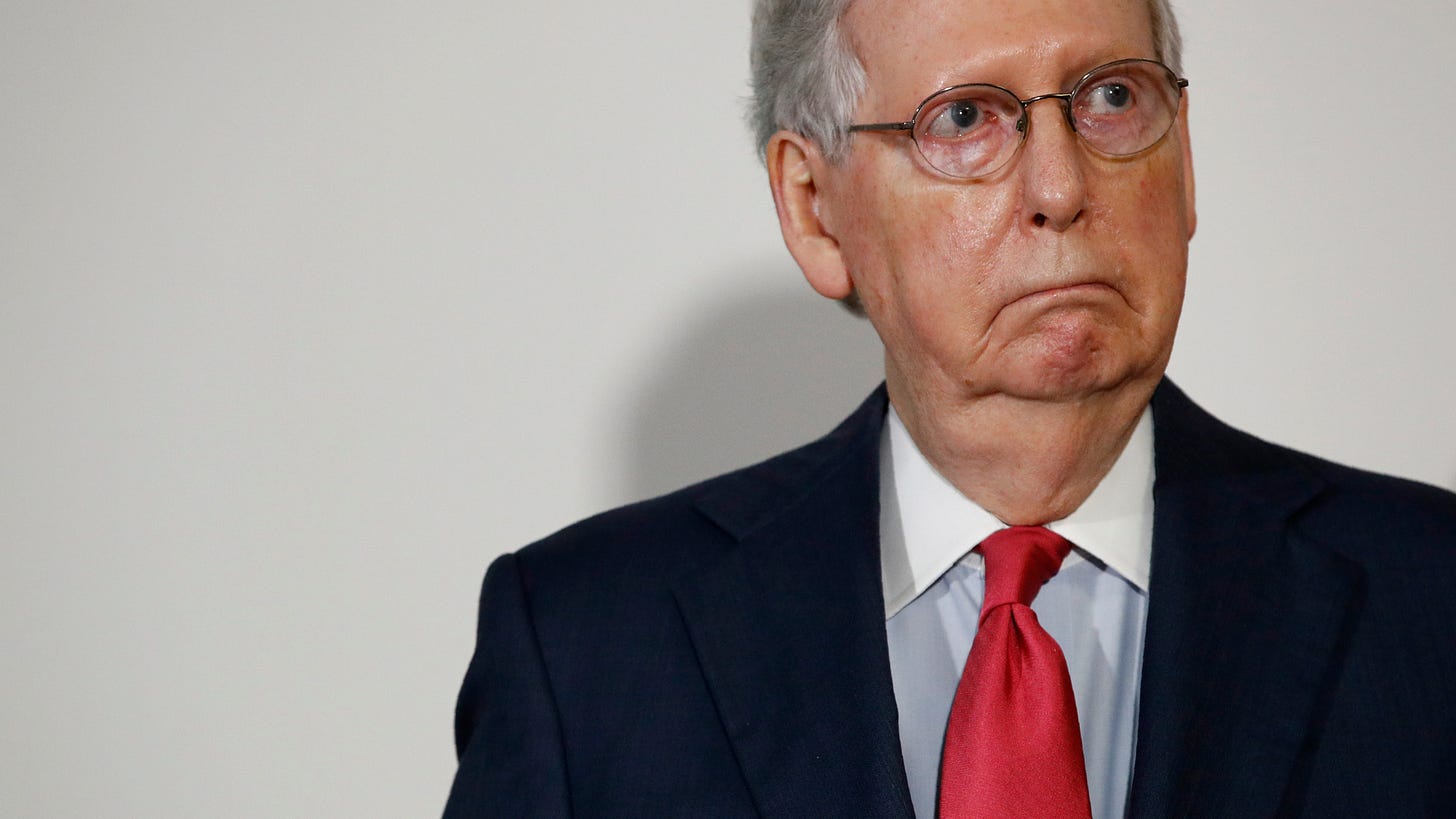

You'd think Mitch McConnell would be smarter.

Once again, this time with feeling: Mitch McConnell is bad at his job. To be sure, the Senate minority leader is good at obstruction.1 He’s good at breaking the rules to win. But otherwise, when it comes to coalition-building, deal-making and “bringing home the bacon,” McConnell can’t hold a candle to true political masters, like Nancy Pelosi.

The things McConnell is good at, which are bad, may end up being bad for him and the Republicans, which is good. Why? Because “the political paradigm,” as I wrote Monday, is shifting so that everything everyone thought was bad over the last four decades is going to seem good in the near term, while everything everyone thought was good over the same period is going to seem bad. The best way of illustrating this is by calling attention to the fact that we’re talking about raising taxes. A frontpage headline in the Sunday Times: “Democrats Seek to Raise Taxes on the Richest.”

That the Democrats are talking about raising taxes at all is, well, mind-blowing, though it may not seem that way to those who have forgotten how we got here, or who have no memory of a time when the taboo against raising taxes was not Washington orthodoxy. Raising taxes has been verboten for going on three decades while over the same period there was a bipartisan consensus according to which cutting taxes was always good. The last president to push for raising taxes, without having the increase obscured by unrelated measures, was Bill Clinton. Yet the 1993 bill he signed into law did not aim to fund programs in the national interest. Instead, it aimed to reduce budget deficits.

Everything everyone thought was bad over the last four decades is going to seem good in the near term, while everything everyone thought was good over the same period is going to seem bad. For instance, taxing the rich.

Which is another way of saying that no president in the intervening 28 years has found it advantageous to raise revenues to pay for things the country needs—and it shows. Bridges are collapsing. Water mains are bursting. Sea levels are rising. The United States, in general, consumes more than it produces, leaving money on the table for countries like China. Oh, and over half a million Americans are now dead thanks to the old ways of thinking that called for the government to divest itself from American civil society. This, as Michael Lind once told me,2 was always dangerous nonsense. “America’s commercial and military competitors are nations that have far fewer qualms about using government to promote their goals and that view government and the market as partners in a common project of national development,” Lind said.

So it should be with no small amount of appreciation that we are witnessing, perhaps for the first time in your life, a president pushing for ways to pay for a “sprawling collection of programs,” according to the Times, “that would invest in infrastructure, education, carbon-reduction and working mothers,” and cost as much as $4 trillion. About half the programs would be paid for by raising federal revenues on large corporations and individuals earning yearly incomes exceeding $400,000.3 Importantly, the question is not if the Democrats agree on the largest federal tax increase since 1942! According to the Times, the question is whether they agree on certain details.4 Even more important, the Democrats can go solo. They can jam legislation through the Senate using the budget reconciliation process, which requires a majority only.

Here’s the tip jar!

Business groups and the congressional Republicans are against raising taxes on big firms and the very obscenely rich. They say it “will slow economic growth and undermine American companies,” the Times reported. This is a textbook line of attack for Republicans. It’s also not working, as it used to, perhaps because growth has not materialized to replace what the government used to do. This attack, therefore, isn’t denting Democratic thinking or majority opinion. Even the old “class warfare” gambit is failing. John Kennedy, Senator from Louisiana, said, “[Biden] wants to allocate the tax responsibility in this country on a basis of class. That’s a hell of a way to make tax policy.” But most Americans, including conservatives, think “class warfare” is jake.

McConnell seems to think unanimous opposition to raising taxes will be good for the Republicans in 2022 the same way unanimous opposition to Obamacare was good for the Republicans in 2010. That may seem like a safe bet, but again, the political paradigm is shifting. Biden understands, as Lincoln and Roosevelt did, that giant emergencies demand giant responses, and only the United States government can do that. McConnell is creating conditions in which not a single Republican will be able to take credit for the seismic transformations that $4 trillion can buy. While obstruction yielded profits in the recent past, it may bankrupt the Republicans in due course.

—John Stoehr

See today’s column by Bloomberg’s Jonathan Bernstein.

The other half with borrowing.

For instance, should the corporate rate be 28 percent or 25 percent? Should revenues include taxes on consumption and wealth as well as income? Don’t expect these to scuttle solidarity.